How to Create a Mobile Peer-to-peer Payment App

The peer-to-peer (P2P) payment field is booming, with customers transferring billions of dollars through mobile payment apps. Reducing the intermediary is becoming the norm for speed and lower fees. Making peer-to-peer payments using apps, such as PayPal, Zelle, and Venmo, fits into a mobile on-demand culture and will increasingly be an essential part of the economy.

As we have quite a bit of experience, we set out to bring you this guide on how to create a mobile P2P payment app. Let’s take a deep dive into mobile payment app development.

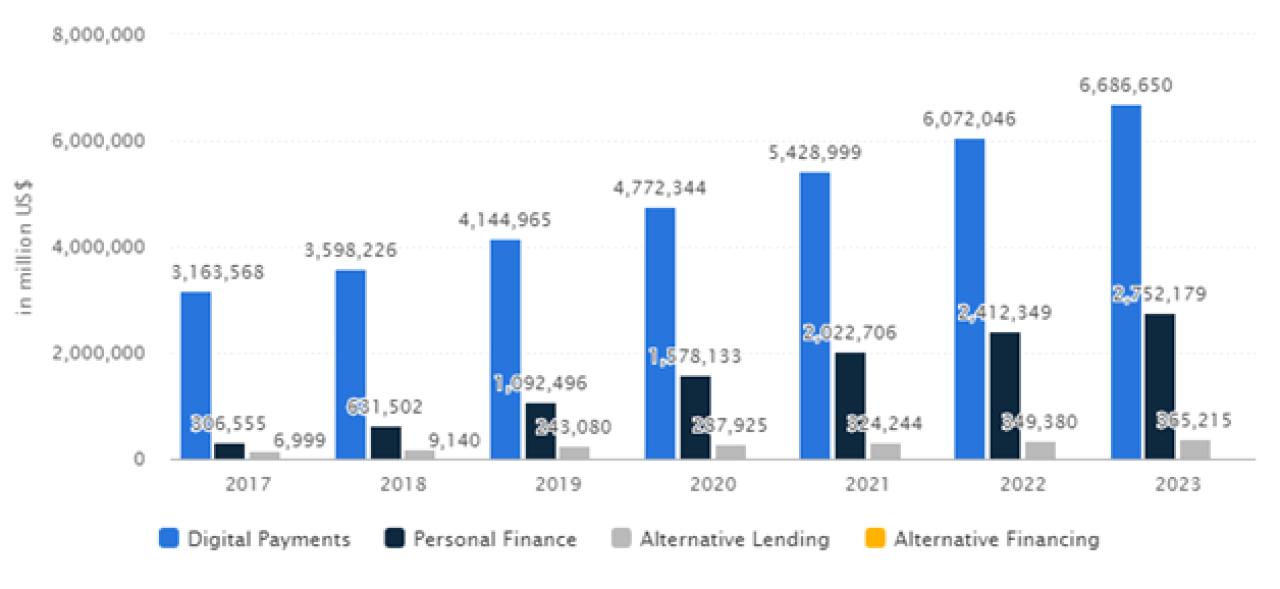

Here is a chart from Statista showing the increasing growth of transaction value in the financial sectors

How Peer-to-Peer Payments Work

A P2P payment system acts as an intermediary that helps people transfer funds from their bank account to another person’s bank account using P2P applications. In short, you choose who you are sending money to and the amount of the transaction and then submit the payment. Depending on the P2P payment service you use, the time it takes for money to transfer can range anywhere from a few seconds to three business days. Many applications keep the money stored in the app until you release the money into your banking account.

Peer-to-peer apps have gained immense popularity among millennials, who generally show more trust in sharing their financial data with third-party software, compared to their less tech-savvy predecessors.

Peer-to-peer payments are also becoming more prevalent in business transactions. A remote employee or freelancer could be anywhere in the world, but traditional banks may not allow wire transfers to certain countries or may charge high fees. The P2P fund transfer makes the process so much simpler.

Comparison of the Best P2P Payment Apps of 2019

PayPal is one of the oldest and most trusted P2P apps, but there are numerous alternatives. To achieve a better understanding, we recommend you first to discover more about the types of P2P payment apps.

- Standalone payment apps. These payment apps have their own mechanisms that accelerate money transfer. They all have an offline wallet feature that allows users to store money before offloading it to a bank account.

- Bank-centric payment apps. These applications involve a bank as the transaction party. There are two types of these app categories: when a bank has a mobile app and when the P2P payment app can transfer funds via its credit unions and partner banks.

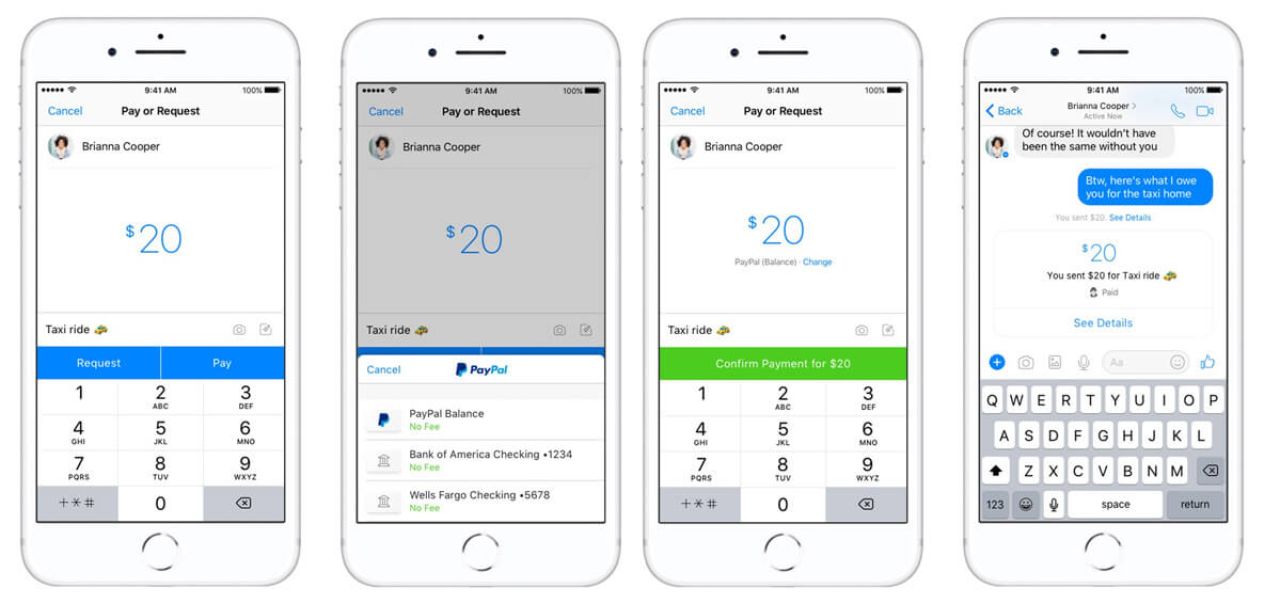

- Social media-centric P2P payment apps. An app has a payment option that enables transferring funds without leaving the social media app.

We have analyzed the following P2P apps: PayPal, Vemno, Dwolla, Zelle, Popmoney, Snapcash, Facebook Messenger, Google Wallet, Cash App, and Apple Pay. Let’s take a closer look at the following table that provides a summary of these ten systems.

| P2P Payment Apps | Bank-centric | Fees | Stored Value |

| PayPal | No

Publicly held company NASDAQ: PYPL/ |

Send P2P using a debit/credit card: 2.9% plus $0.30 in fees if using a bank account (ACH) | Yes |

| Vemno | Yes

Acquired by PayPal in 2014 |

Send P2P using a debit/credit card: 3% plus fees if using a bank account (ACH) | Yes |

| Dwolla | No

Privately held by investors |

None for P2P | Yes |

| Zelle | Yes | None for P2P | No |

| Popmoney | Yes | Send P2P using a bank account (ACH): $0.95 Credit cards not accepted | No |

| Snapcash | No

Build on top of the Cash App |

None

Debit cards only |

No |

| Facebook Messenger | No | None

Debit cards only |

No |

| Google Wallet | No | Send P2P using a debit/credit card: 2.9% plus $0.30 in fees if using a bank account (ACH) | Yes |

| Cash App | No | Send P2P using a debit/credit card: 2.9% plus $0.30 in fees if using a debit/prepaid/bank account | No

Funds come directly from a bank account, sent directly to a bank account tied to a debit card |

| Apple Pay | No | $0 if the transfer is funded by a debit card

3% if funded by a credit card |

Yes |

P2P Payment App Features

We compiled a list of must-have features to keep in mind when you develop your own custom P2P payment app.

- Unique ID/OTP. For security reasons, a user should verify a unique ID or pass for each transaction. Users should be able to see all transaction details. Some P2P payment service providers ask for the OTP every time the app opens to ensure a higher level of security. The fingerprint scan adds an extra layer of security to your app.

- Notification. This feature allows users to receive information about their account or wallet activity. It can also notify users of upcoming bill due dates.

- Bill and invoice sending. This feature will be able to scan and send invoices to a user. Note that a generated transaction invoice is received by both the sender and receiver.

- Transaction history. The transaction history feature provides users with a summary of all their transactions made through P2P payment apps.

- Chatbot. A chatbot feature that is built into existing platforms can improve apps like Vemno or PayPal. Chatbots are projected to save the banking industry tons of money. We frequently communicate through messengers. Therefore, it is natural that we transfer payments and interact with bots in apps for daily banking needs.

- Transfer amount to a bank account. This feature enables users to transfer the money from the app to their bank account. Every money transfer app has its own business model, according to which it charges a small fee.

- Admin panel. The admin panel allows you to manage the app, edit, remove, and so on.

- Fingerprint app lock. While P2P payment apps contain important bank account details and credentials, it is important to provide security to its users. The fingerprint lock feature ensures that only the user of the app can access his or her account.

How to Create a P2P Payment App and Avoid Potential Pitfalls

If you want to develop a P2P app, you need to think about the following issues, which may present challenges. Here is what you need to know to build a P2P app and obtain all the perks while avoiding any possible downsides you may not be aware of.

Security

Security is one of the essential issues in the mobile P2P payment industry. Because a large amount of private data are stored in one place, it is important to create a secured data record management system. Ensure that your P2P mobile app does not display a user’s credit card number during a transaction. It is best to implement fingerprint and PIN authentication in your app to approve transactions.

PCI DSS Compliance

We recommend that every business dealing with confidential banking data should follow the PCI DSS compliances to ensure that the credit card data provided by cardholders are protected. To obtain a certificate, all businesses that store, process, or transmit credit card data electronically are required to follow the requirements below:

- Develop a secure system;

- Have a vulnerability management system that scans the current network, analyzes risks, and prepares reports through constant monitoring;

- Implement strong access control measures;

- Protect data privacy;

- Test and monitor systems; and

- Manage and update the information security policy.

Support for all the Main Online Payment Systems

Note that your P2P mobile payment app should support the following payments types:

- P2P payments within the system,

- e-commerce payment gateways, and

- in-store and on-the-go payments.

However, to engage your target audience, you may include the following features:

- staggered payments,

- paying taxi services, and

- borrowing limits for friends and family members.

Prevent System Overload

To prevent the overloading of your system, you could start building your P2P app as a cluster solution from the beginning. This will allow the capacity of your system to grow in proportion to its growing number of users.

Calculating and Converting Currencies

There are 180 currencies across the world, and you should create a mechanism that tracks money conversion and transfers funds as soon as possible.

Choose the Technology Stack

Just one second could cost your business a billion and could cause a higher abandonment rate. Note that native apps load e-commerce apps 10% to 20% faster than other apps. Consider this when choosing the technology for your payment app project.

How to Monetize your P2P Payment App

Let’s determine which monetization model you can choose to boost revenue and drive your business growth:

- Transaction fee. This model allows you to charge a percentage of every in-app transfer. The transaction fee is logical and convenient to develop and integrate. However, this option is not the top choice.

- Ads. This model allows you to be paid by ad owners for each ad show or click. However, note that all the ad content should be manually checked to exclude inappropriate content.

- Freemium. This option has become the dominant business model that allows users to access additional functionality for a subscription fee.

How Much Does It Cost to Make a P2P Payment App?

Now that you have learned more about the monetization options, let’s look at how much it costs. Summarizing all the factors and making a crude approximation, a basic P2P app will cost around $50,000. However, it can be more expensive, depending on the team’s hourly rates.

Contact us, and we would be happy to provide more accurate cost estimates based on your project specifications and to outline the different content production options that are possible.

Darina Confidus says:

Great article. Your blog contains professional content, many thanks for that! This is exactly what I was looking for!

Emuobo Madago says:

The article has really gotten my interest. I am going to bookmark your blog and keep checking for new details every week. Many Thanks!

ปั๊มไลค์ says:

Like!! Great article post. Really thank you! Really cool.